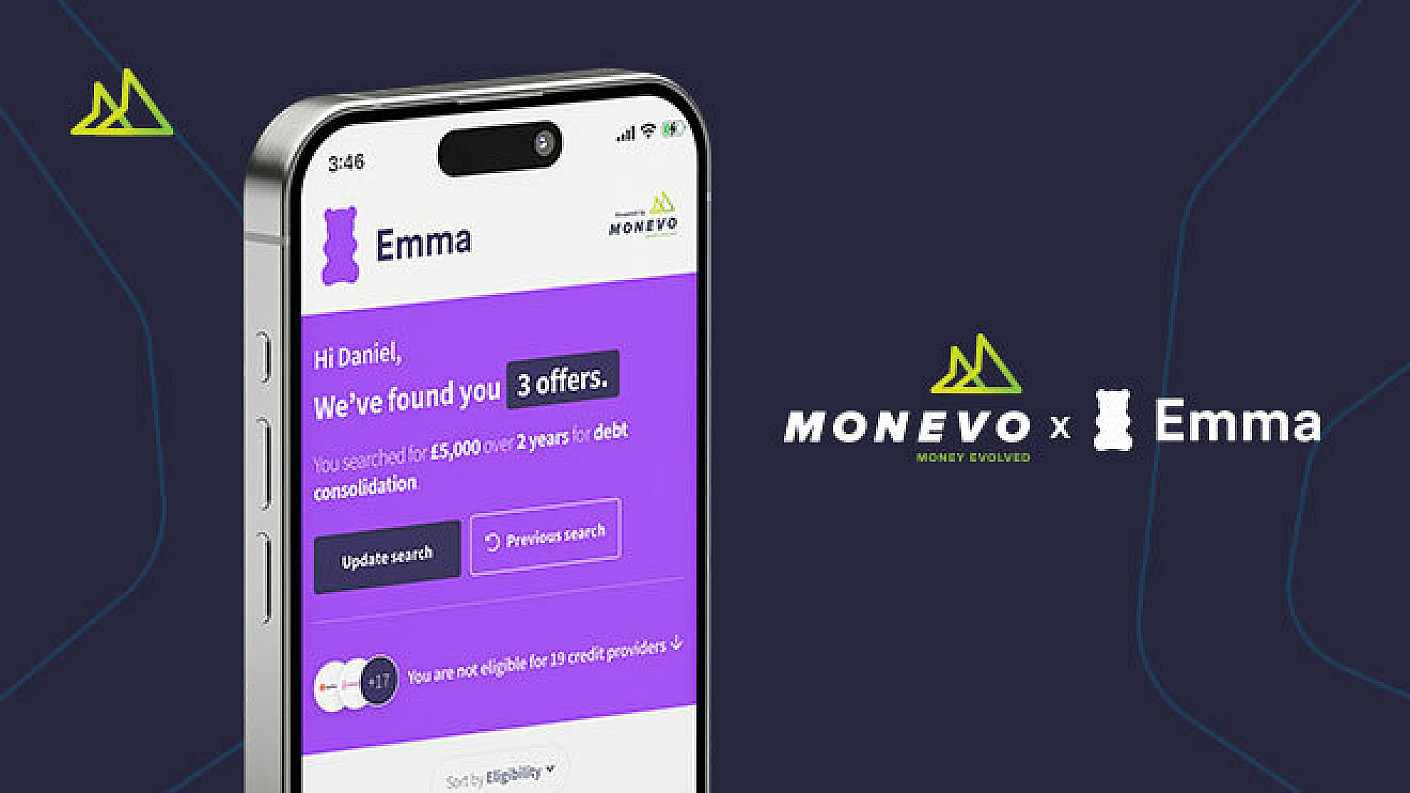

Emma is a financial super app that allows customers to track their money in one place and start saving, investing and sending money. Emma’s primary use case is to help customers budget and save money.

As part of Emma’s experience, we can introduce customers to loan and credit card opportunities. This is particularly useful for customers who need to consolidate all their debts in one place and those who have just started working and might have only some financial products, such as a credit card.

What’s powerful about introducing these financial products is not just the fact that customers can discover them in the Emma experience but also that they can track and use them in the app thanks to the power of Open Banking. Their typical customer would open a credit card and then link it to the app so they can track their spending and manage repayments.

Emma’s mission is to help customers regain control by saving more and spending less, and so far, it has helped over 1.6 million customers in the UK and is one of the leading Open Banking players.

With the introduction of Monevo’s powerful tools, customers can now see what the lending market offers, allowing them to choose what products to adopt. This has improved the relationship with customers, who now feel empowered and can always have a view of the market without buying into an individual product.

Emma chose Monevo for their systems' ease of use and fast integration. Monevo is the only company in the market providing multiple solutions to integrate their lending panel.

This allowed Emma to test a variety of journeys. Emma is a mobile app, so they needed a lot of flexibility to understand what worked with their customers.

We started the partnership with a white-labelled web journey, then tested a hybrid one with a mix of API data and then moved into an entire API journey, which has increased the conversion by 10x.

Emma has offered an exceptionally vast panel to its customers and improved conversion rates to both loans and credit cards by utilising the range of products built by Monevo via the Emma mobile app and email marketing.

With Monevo, they witnessed an increased conversion rate across Emma’s borrowing proposition, which aims to introduce customers to loans and credit cards. We expect this partnership to last very long, and we are excited about what’s ahead to make the experience smoother and more accessible for customers.

In regards to the partnership, Edoardo Moreni, co-founder and CEO of Emma, said, "Our partnership with Monevo has enabled Emma to keep focusing on what we know best, building a great product while providing borrowing opportunities to all our customers without having to take care of the business operations behind the scenes. We are thrilled to continue this cooperation in the next few years."